Bank of America’s earns a 4.0-star rating from 4576 reviews, showing that the majority of banking clients are very satisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

credit card rates

I am experiencing problems with credit card debt and tried to talk with BOA. Customer rep would not let me speak with manager to discuss issues with interest rates. I am a good customer for several years with no late payments. I was told if I didn't like it and stopped paying then I would be turned over for collection and my credit affected. No discussion, no alternatives, and these people take money from taxpayers to stay afloat. By the way Rachael Peters is the customer rep who says she is authorized to to inform you that you either pay or lose. Pitiful organization.

thanks

F meyer

[protected]

The complaint has been investigated and resolved to the customer’s satisfaction.

interest rates

I have good credit and pay my bills on time, every time. - Bank of America informed me that due to "risk review" (yeah, right) they will be DOUBLING the interest rate on my credit card. Of course I can "opt-out" but if I use the card, all current and future charges will be subject to the new, DOUBLED interest rate. AMEX, Citi, and all the other credit card issues are doing these same things to their customers.

How can these banks get away with this? How does the Government expect the economy to recover if the all-important consumers keep getting shafted by the banks. Many of us will never be able to completely pay off these cards. These banks by the way are keeping the bailout funds provided by the gov't and they are spending billions at the same time to acquire other banks. Something is clearly wrong here.

The complaint has been investigated and resolved to the customer’s satisfaction.

I would like to add something to my about comments. Please call all of your elected officials and give them your feelings at http://www.usa.gov/Agencies/Federal/Legislative.shtml. Banks are borrowing money at record low prices and we are paying record high interest rates.

I agree, I have basically the same problem with B.O.A. more than doubling my interest rates. We paid to help them in the bailout and now we are being forced to pay them in interest rates. I would pay them off but with the economy the way it is my business has less money and the higher rates are even making it harder. I believe this now policy, in the long term will destroy them but we will have to pay in the mean time.

false nsf' charges

I want to make this short and quick. Bank of america has a scam going called check 21 rule. It's a scam that creates "false overdrafts" you can keep your accounts in the black all you want and it won't mean a thing. They create the overdrafts for you.

It is bank fraud pure and sweet!

I'm going to file suit against them asap. If you wish to join this civil suit email me here with your contact info and you will be listed on the suit as a plaintiff against bank of america. I will make sure that you are contacted by the attorney before the suit is filed. The more people that have the guts to slap them down the faster they will fall.

They are not a bank, they are racketeers!

The complaint has been investigated and resolved to the customer’s satisfaction.

I was with B of A for about 5 years and hated every day i went in to the bank. I was also confronted with NSF fees that i had to fight tooth and nail for. when i tryed closing my account they intentional did not close it. I asked for it to be closed due to the IRS problems that i had. The girls that was helping me close the account stated that it was closed and i did not need to due any thing else. a month later i recieved a new ATM and a statement stating i owed them 200 dollars for a IRS set up fee. I told them what they can do with 200$$. They did send me to checks systems however. You would think after all the NSF fees that they charge people with, why in the hell would they need to be bailed out. They get what they deserve.

world points

I just received notice from B of A that my credit card account has been closed due to my credit report rating. My credit card has been paid on time and all my credit cards do not have late charges on them. Due to the economy and lay offs my husband has not been working and we have had problems with our Mortgage. Since my credit card is closed now I attempted to get my 12000 points that I have accumulated which B of A said No since it was the company that decided to close the account and not myself. This is upsetting and NOW I do not want to pay them what is due.

The complaint has been investigated and resolved to the customer’s satisfaction.

WORLDPOINTS IS A SCAM!

WORLDPOINTS IS A COMPLETE SCAM!

Hey Cali, the same thing happened to me! I had 15, 000 Worldpoints accumulated. Did you ever manage to redeem them? This is so unfair, I did not owe them anything at all and they decided to cancel my credit card. They can do whatever they want in terms of cancelling my account but I earned those points fair and square and still have every right to redeem them, that's $120!

Fees and Bill Payment

I used a new checking acct to make my monthly payments. FIA Credit Cards online payment company initially stated all was wonderful but then a few days later told me the payments were unsucessful. As the payments were well ahead of the due date I attempted to remake payments but the payment company blocked my efforts and would not co-operate with me to correct the payments.. I had to go directly to the financial institution I had set up as the "pay from" account and set up the payments directly from their bill pay system as the problem was not insufficient funds just incompetent people unable to process my payments at FIA's check free bill pay system! Due to this fiasco with their "Bill Pay" system I was penalized with multiple fees and my account closed ---because of MY ACTIONS! My actions were to make 2 payments totalling well over my minimum payment due weeks before my pay by date! The check free bill payment system screws up processing the payments as it was newly submitted checking account information? and I am suddenly a credit risk and unworthy to be a customer.

The complaint has been investigated and resolved to the customer’s satisfaction.

From an insider during the date that you scheduled your payment there was a system glitch and you should have been credit for any fees that posted to your account and had all delinquencies removed. Please make sure when you call them the next time to ask them if they had a online outage during that time.

credit card protections

This is a notice to all bofa existing and/or future customers as a warning only.

In december of 2008 I received an automated phone call from bank of america stating that odd activity had been happening on my credit card account (Thanks to bofa for the notice). I was asked if several charges were in fact mine - which they weren't - and I was immediately connected to a fraud specialist. I live in southern florida, and the activities occured in southern california - 2 stores. While talking to the fraud specialist, I was informated that they had undergone a conversion in november, and had sent me a new card (Which I never received). Apparently (They told me) somehow my new card was diverted to somewhere in southern california because the purchases showed in bofa's system as being done with card in hand. At any rate - the account was closed, and a new card was issued and mailed to me.

Two things came to pass. First - the card that supposedly was diverted to california actually arrived at my home address the following week. Then, in another week, the new account card arrived. Second - and the major reason someone was able to use my account - neither new card required activation by calling a bofa number to authenticate that the right person had received the card. Because of this change in their processes alone, someone was able to make charges on my account, from which I was required to complete an affidavit and return to bofa to keep the charges from returning to my account, plus the time I was without the card just before christmas.

To existing card holders - be aware. As you approach the end of your current accounts valid dates, keep a close eye on your statements to watch for suspicous activity. If bofa were smart, they would return to requiring authentication for replacement cards, but if they don't then they're creating a potential issue for many customers.

Thanks for reading,

John

The complaint has been investigated and resolved to the customer’s satisfaction.

mortgage modification denial

First of all, my website containing my petition against Countrywide Home Loans: http://www.petitiononline.com/mortgage/petition.html

Countrywide has been absolutely horrible to work with in regards to a mortgage modification. I requested a modification because I strongly believe that Truth in Lending errors and possible RESPA violations were done when my loan was underwritten.

When my 2nd mortgage was funded, I was told the value of my home was $158, 000 through an online valuation they use. It turns out the online valution compared my condo (studio) to 1 and 2 bedroom condos in my area and over valued my home by $68, 000! Now I am seriously underwater and Countrywide refuses to work with me or even do the forensic audit I requested them to do. Twice I've asked them and twice they denied my modification request. Now Countrywide is telling me they will file foreclosure proceedings against me in February hence the reason for me putting up my petition.

Countrywide is horrible!

The complaint has been investigated and resolved to the customer’s satisfaction.

My husband bought the extra disability insurance from country wide and when it came time to call on it we were told that it only covered 3 months (he broke his neck and back in july 08) we were told we had to wait 3 months before we could call on the policy, mean while 4 months after repeatedly calling country wide to try to make arrangements to no avail we were put into fore closer we tried to lower our payments tried talking to their bank and their attorneys and again to no avail we got no where but a summons to appear, when we explained about the extra insurance country wide stated that it was not their insurance it was outsourced not their problem so the courts agreed and started proceedings to foreclose after sitting in court all day we head to the bank to be told we were overdrawn on our account which was odd we had just enough to keep it open . long story short we get home and read our mail, , , we received a letter from country wide stating that an employee(now an ex employee) had sold my husbands identity .. we file A POLICE REPORT AND TO THIS DAY COUNTRY WIDE WILL NOT TAKE RESPONSIBILITY for our overdrawn account nor for the foreclosure on our home there was so many ppl we spoke with we couldn't keep track of who we spoke with after 3 notebooks and nothing but runarounds and alot of bsing from them i would place my family in a cardboard box before we took a penny from that company again so ppl please watch carefully to make sure our information stays just that yours

I lost my job (as a Mortgage Loan Closer) and contacted CountryWide to see if I could refinance to lower my payment. The loan officer said I could do the FastTrack loan and eagerly took my non-refundable $380.00 fee. Three months later I havent heard back from them. My phone call, which of course every one passed the buck, revealed I was denied approval for a new loan. How nice of them to contact me and let me know! By this time I cannot make my mortgage payments. I call again to get help. What a joke! No help available..." just stop making your payments" is what I got out of it. Absolutely a waste of time and $380.

Loan Consolidation

I have five loans with Countrywide Home loan I have never been late on any of the loans, I contacted Countrywide and I explained to Frank Fimanio that because of the economy I am having a problem paying the first second and third I have on my primary residence so I need to consolidate the loans into one loan, he said he would have to run my credit. After running my credit he said if he was to consolidate the first, second and third on just one loan I would be saving approximately one thousand dollars a month, I said great. He then said I need to provide proof of income I explained to him that I am self employed and business is bad just like the economy but I provided my 07 tax returns. I was then transferred to Eric Lopez and after checking my tax returns he said I did not qualify to consolidate the loans in other words I need to prove I can pay one thousand dollars less a month to qualify for the loan. I was then transferred to the home retention department and I spoke with Faith [protected] ext 7894 she asked me questions, I answered and then she told me I did not qualify for anything because I am not delinquent. I am currently paying approximately $2, 500 extra each month Countrywide refuses to consolidate even one of the five loans I have with them. I spoke to numerous persons at Countrywide and they said basically as long as I am current we cannot help you and I don’t earn enough to justify consolidating the loans which will reduce my monthly payments. I explained to Countrywide that because of this economy I have burnt though my savings and I am running out of options. I called Countrywide at [protected] ext 8605 on January 06, 2009 and I spoke to Gabrielle and I explained my situation desperately trying to save my property and my credit, she said if I do not make the payment on time there will be a late charge and my credit will be impacted and if I fall behind I could sell the property back to the bank. It seems to me that is what Countrywide wants me to do. After putting a large down payment and paying on my property for years give it to Countrywide. Is not the billions Bank of America received from the government enough?

The complaint has been investigated and resolved to the customer’s satisfaction.

I applied for a refinance loan with Countrywide at the end of March of 2008. After completing the application process and paying $400 for an apprasial, they told me everything was set, and my loan was approved and underway, with no out of pocket closing costs. I waited 3 weeks to hear from them regarding a closing date, and I came to find out that my agent was on vacation getting married. The manager that was supposed to take over my loan while she was gone never called me, even after my repeated phone calls (always getting voice mail). When she finally contacted me at the END OF MAY, she said that it turned out that I would need to pay almost $5000 at closing, oops. Needless to say I am disgusted, and will NEVER use Countrywide for ANYTHING, and will encourage my friends and family to do the same.

Countrywide's Home Retention Team should be thrown in jail with the CEO..Forbearance Agreements should be outlawed, and the Attorney General should have stepped in long ago. Throwing the CEO of Countrywide in jail is not enough. Corruption charges should have been filed on everyone that was involved illegal practices. Duping consumers into coming up with huge amounts of money then without blinking an eye continuing to foreclose on their homes is unbelievable. Where is the justice? The entire legal system needs some serious attention. I am very disappointed in our system. An Attorney I hired told me that there is no justice for the middle class...How SAD..

I read how the interest rates were dropping and now is the time to Refinance. Countrywide is my current loan holder so I called them to inquire about refinancing. I went over all my information and the representative pulled up my information and told me what my new interest would be and what the closing cost would be, approx 8000.00, which to me is too high, principal & interest and what my savings would be. He even said you may want to right this down. He even gave me what my savings would be. All I had to do to get the ball rolling was pay for my appraisal upfront. And I did.(DON'T DO THIS) wait until you receive the paperwork then pay for the appraisal if you want to move forward. Now that I look back I think that was his way of trying to give me a heads up. When the paper work arrived I went over it against the information I was given over the phone. The appraisal was done by a reputable company. I did check them out. BUT, Countrywide charged me more for the appraisal then it actually cost. Once the paperwork arrived and I went over it the closing cost were more than 13, 000.00. When I called them and spoke with my contact person, she told me that my interest was more. Also, on the paperwork the payment was higher than what I am paying now. THERE WAS NO SAVINGS. She didn't have to say another word. I told her THROW my paper work away. I will not be doing another loan with Countrywide. And I am keeping my paperwork. They may have settled lawsuits recently but I think they are still doing some shady business.

The mortgage company at the first of the year or in February changed their service fees. I choose bi-weekly method and depending on the day you wanted to schedule a draft, which could also include a late fee. So, I decided to go through MyFreeCheck.com to arrange the bi-weekly payment. That was in March, so the mortgage company was not drafting my account. But since then in Feburary/March I made an extra payment they have been taking out late fees from that payment I made. Is this legal for fees and dates to be set so that you have no flexibility. Although you have a 15 day grace period and a thousand stipulations if it is not submitted by the first. So, when I was submitting half of my payment at the end of the month and the other half before the 15th Countrywide was taking one payment that made it outside of their color coded date chart.

So, it made it late. I think this is taking advantage of customers.

Thank you for your assistance!

I went to coutry wide home loans and got scamm by the home loan consultant and the realtor Noe ventura, they were charging me up money to fix my credit and other fees that i later found out were false, when i confront them Noe ventura call my friend a told him for me to shut up or he was going to call immigration on hime, so i stop for my friends safety and mine and my family after getting harras over the phone, email and text. Noe Venture is a thief . i even got a police report on them after. Stay away.

Interesting point about loan consolidation. We have two loans with Countrywide, and we asked them to bundle the existing loans into one. ie making administration easier and hopefully saving some money.

Their response, they wanted to reappraise our property, and for us to pay thousands in closing costs - thus increasing our debt or for us to pay cash upfront. (which is totally unacceptable) I understand paying local mortgage registration fees and taxes but not for an appraisal and commission on a property they already have on their books. Surely to make two loans one is only a computer administration issue not a sales function.

Also, they questioned our income implying we earned too much to be considered for a consolidation - that was after talking about the appraisal and fees. So what is too little and what is too much - it seems that everyone is in either category, thus they do not have to consolidate anyones loans!

This organisation is out to make money, the borrowers are not their customers the banks, brokers and realtors are. As you say what has happended to all our money - we are taxpayers i.e. they are now our customers! - the government would have been better off giving everyone a tax deduction/cash return instead of bailing out the 'old boys club' in the finance industry. We need some tight regulation of these groups as obviously they are not capable of doing that themselves.

Countrywide and other financial institutions are out for themselves and no-one else. They pay low wages, do not train their staff to handle situations and to listen to their customers/borrowers - all they want is your money. Hopefully it will come back to bite them soon.

Everything is done within the 'grey area' which is very difficult to prove in a legal situation but is bad business ethics.

same up North with mortgage and public housing...

It's not taking advantage of any one. How the payments are to be made are spelled out. Follow the instructions and you will not get a late fee and your credit report will not show repeated late payments. Stop using the “grace period” as a cushion. The due date is the due date. One second into the day after the due date it is late! PAY your bills BEFORE the due date and your self inflicted problem will go away.

online bill pay

Damon Brown

20 Bay Cove drive

Stockbridge, Ga 30281

Acct #[protected]

Acct#[protected]

[protected]

[protected]@yahoo.com

thank you for destroying my life. For 2 months i've been having problems with online banking pulling funds from the wrong account. i've been trying to stop this . i call every two weeks when this happen and a representative walks me through step by step and tells me the problem has beeen solved and this wont occur again. two weeks later this occurs again and i start the process over again. the rpresentatives dont take notes for the next time when i call so it causes more problems and they are not aware that this has been going on sometime but i beleive the representatives are trained to make the customers fell like they are at fault. up to today this problem has caused major major problems. i have direct deposit and it is almost taking my check every two weeks. bills are not being paid water turned off and etc. since Dec this has cost me (including my pay check )around $2000 and counting. my purpose of opening my new account and start using online bill bay was to manage my money better, watch what im spending and to keep track of my money being the way the economy is. Big mistake. Bank of america made my life a living hell. i would tell everyone to run far from this bank. the worse. I've contacted BBB and i may contact other local television to tell the people in georgia beware of whats going on. the online bill pay is to confusing and ruined my life. Now i know when someone at bank of america read this letter. no actions will be taking and thats fine because they probably get letters like this frequently but if this will stop them from doing to other people what they done to me then that good enough for me. and if you can sleep at night after treating people this way then God be with you.

The complaint has been investigated and resolved to the customer’s satisfaction.

I have been using online Bill Pay through my personal BofA account for at least seven years. Last month, I paid two of my credit card bills online and somehow that information was lost from their system. Fast forward to this month, I receive my statements showing late fees and interest charges that should not have been. I called BofA and they informed me they had no record of the transaction (naturally) and suggested I write down the confirmation numbers presented when submitting online bill payments. Lesson learned for me. I have to believe that there was some internal system issue that lost my data, and am posting this to see if others have ever experienced this issue. I have never had this issue before, pay all my bills on line each month--- just seems very suspicious that two bills I submitted for payment in the same session were not paid. I do agree that it could have been user error (me) but think it was pretty unlikely given my experience in using the UI.

Has anyone experienced a similar issue?

We are casting a documentary about unfair bank policies. Looking for stories with complaints about banks. If you are cast we will pay you. If interested contact bellmartel@sbcglobal.net for more information. Casting needs to be concluded by May 1st, 2009.

secret life insurance policies on employees

A Texas law firm is investigating Citigroup and other banks for taking out secret life insurance policies on current and former employees, and collecting the benefits when they die.

http://insurancenewsnet.com/article.asp?n=1&neID=20090113290.2_e8e10061f739577c

HOUSTON, Jan 13, 2009 (BUSINESS WIRE)-- Attorneys from Houston's The Clearman Law Firm ( www.clearmanlaw.com ) are announcing a nationwide investigation of banks that have purchased secret life insurance policies in order to collect benefits when current and former employees die.

Many of the world's largest banks have purchased "bank-owned life insurance" or "BOLI" for years, including Bank of America, JP Morgan Chase, Bear Stearns, Citigroup, Wachovia, Washington Mutual, Wells Fargo and many others.

"We are investigating banks that insure the lives of employees without their knowledge or consent, " says class-action attorney Scott Clearman of The Clearman Law Firm. "These types of policies benefit only the banks, not their employees."

In a BOLI program, a bank designates itself as the beneficiary of life insurance policies covering its employees. Nearly half of all U.S. banks have reported owning BOLI policies at an estimated value of $120 billion.

A bank purchasing a BOLI policy must provide the insurer with personal information belonging to each covered employee, including his or her name, sex, age and Social Security number. Employees' Social Security numbers are then used to conduct "death sweeps" where banks typically hire outside brokers to sweep public records in order to learn if an employee or former employee has died.

A person whose life a bank insured without consent may have a right to sue for the bank's misappropriation of their identity (name, sex, age and Social Security number). Employees may be able to recover profits made by the bank, broker and insurer.

"It is ironic that thousands of bank employees have been laid off, and yet the banks still stand to benefit financially when those employees die, " says Mr. Clearman.

Since the early 1990s, Mr. Clearman has been a pioneer in class-action lawsuits against employers for wrongfully insuring employees' lives for the employers' benefit. Following several individual lawsuits for the families of deceased employees, Mr. Clearman pursued landmark class-action claims against Wal-Mart and Fina that resulted in major settlements for his clients.

The complaint has been investigated and resolved to the customer’s satisfaction.

stop fee

I requested a st0p payment a few days ago thinking that it would be better for me have the check destroyed and stop the payment of the check just in case someone found the check and tried to order something online. I checked my account yesterday and found that I was charged $28 to stop payment on a check. If I would have known that there was going to be a fee, then I never would have proceeded. I did this online and I was never prompted that there would be any fee. However they informed me that in the little print (8.5 font) that it mentions that a fee could be charged. I'll be damned they were right. I tried to explain to their customer service department 3 different times, 3 different people and they all told me that the could reverse the stop payment, but they could not reverse the fee. Bank of America has the worst customer service that I have ever experienced with a bank. I guess if you want to be able to have banks all over the country, you have to pay for it by crappy customer service and fees that they don't tell you about until it's too late, or in my case they hide it in the smallest font possible and when you dispute it they just send you on your way. AHHH! I just needed to vent and share my experience. Needless to say, I will no longer bank with them.

The complaint has been investigated and resolved to the customer’s satisfaction.

I experienced the same thing. It SHOULD say "By clicking here, you agree to pay $30 stop payment fee". Instead it says "You MIGHT get charged... click here to see your schedule of fees" If you click on the schedule of fees before proceeding, and look under the type of account you have (e.g. MyAccess Checking), there is NO mention of a fee! However, If you scroll down 10 pages, the 2nd to last box on the page, it says ALL ACCOUNTS INCUR A FEE OF $30 FOR STOPPED PAYMENTS. Why not just put that on the page where you enter in the check # and hit "Continue". Nobody wanted to help me, neither online nor in person, so I closed my account on the spot. A huge pain. I have been with BOA for 10 years and never had to pay a fee for this before but they are just SO unwilling to be reasonable. This is the sort of thing that should have been a no brainer for them to refund. $30 is a lot of money to me, not to mention the principal of them sneaking this fee in after the fact.

We are casting a documentary about unfair bank policies. Looking for stories with complaints about banks. If you are cast we will pay you. If interested contact bellmartel@sbcglobal.net for more information. Casting needs to be concluded by May 1st, 2009.

Unauthorized billing

I authorized FIA Card Services to do an automatic withdraw from my checking account for my credit card payment each month to ensure timely payment of my payment. FIA Card Services is deliberately taking the automatic withdraw 4-10 days after the payment is due and CHARGING A LATE FEE. I am attempting to get the automatic payment stopped but FIA Card Services is reluctant because my account has been PAST DUE and is subject to a LATE FEE--a late fee it created. After some brief internet searches, it appears my situation may be one of a number a common tactics by FIA Card Services to generate $30-$50 late fees on accounts each month.

The complaint has been investigated and resolved to the customer’s satisfaction.

I am having the same issues with FIA.

Raising Interest Rate Arbitrarily

I have been a card holder for 10+ years. I've had the rate of 6% the entire time. I've been paying $100/Month, and have been doing so for about 5 yrs. I get charged $16 or so per month in finance charges, and occasionally make purchases. I don't even look at the statements except online to make sure no charges appeared that I didn't authorize. I'm willing to eat the $16 for the convenience of keeping the 6% rate.

I've continually held a high balance because I've been paying off other debts for these 5 years, and am 3 months away from doing so. This month I noticed on my credit monitoring service that I had a delinquency. I immediately went to my Bank of America site to make sure the payment had gone through. It had.

Low and behold my interest rate had been raised to 19.99% without my knowledge. they had also doubled my minimum payment. I had been lax for the last 3 months, and have now amassed several hundred in late fees and will have my credit destroyed.

Can anyone help me to figure out if I have any recourse? Are there any class action lawsuits out there currently in regards to this? If not, any lawyer want to start one. This is obscene and violates any sense of decency in lending. My debt to incom ration is miniscule, I haven't been delinquent in over 4 1/2 years (they were aware of these). My available credit is pretty substantial, my score is mid-700's, and they are mailing me a statement as to why they raised the rate, but the gist was "concerns over the balance being carried, along with something on a recent credit inquiry that have caused us to raise the rate". I have made no purchases, no new credit, no credit line increases, nor anything which should trigger this.

The rate had gone from 6% to 19.99, and apparently now has gone to 29.99% this is institutional rape. I will be facing years of a lower credit score because some analyst decided that if they raise the rate on a certain niche of people, only "X" percent wil actually check their statements, and because we are so big, they will be forced to pay us fees. This should result in a direct boost to the bottom line of "X"/ per 1000 people we arbitrarily raise the rates on.

This is disgusting and violates fair lending practice.

In this time when the country needs people to spend, I’ll eliminate all credit, not purchase until later and wait until I get cash. I know this is the sensible thing to do, but the credit card companies should throw a parade for people who carry a high rotating balance and pay on time.

I need some legal help, and I'm sure I'm not alone. I now know that I should check my interest rates and every little thing on every piece of paper I receive from every company.

I'm going to need an assistant to do this. Maybe I'll just sue the crap out of them, and have the money to pay to have someone check the fine print on every monthly statement I receive. I’m serious, if there’s a lawyer out there doing this or thinking of doing this, I’m in. FIA, if you’re reading this, shame on you.

The complaint has been investigated and resolved to the customer’s satisfaction.

Fia raised me from a promotional 1.9% to 15.99%. Outrageouss and immoral. This economy will never improve while the banks are allowed to continue with these practices. Doesn't the government see the light? We can't spend on new things and boost the economy if we're trying to pay off our credit card debts at these high rates of interest.

My FICO is over 750, I am in a better financial position than I've ever been and out of the blue, FIA decides to DOUBLE MY INTEREST RATE from 11.99% to something like 22%! Damn crooks!

I also had a FIA account recently, we were paying 12.99% for many years, always paid on time, and always paid double the minimim payment. We were shocked when out of the blue, with no warning, they raised our rate to 27.99%! Our payment doubled, and when I called them, the lady I spoke to couldnt even believe this was happening to us. We have excellent credit, so this made absolutely no sense, and they could provide no answers or excuses. I believe this is against some kind of law. It is so morally wrong, especially in this current financial crisis. Now they just raised APR to 29.99% because we didnt pay the huge bill they sent on time. This is a terrible corporation, please think about not signing up for this credit card, they have shady practices!

endless list

About 3 years ago I opened an account with BofA, checking and savings. I was told that I would get a 25 gift card for opening my checking account, a $10 gift card when I opened my savings, and another $10 for referring someone to their bank. I did all of that. After 9 months or so, I was getting pretty crappy customer service, so I decided to complain about the fact that I had never received any of the gift cards. The person I spoke with said I would need to talk with the person who opened my account for me. That person was no longer there. I moved to another bank immediately.

I still have a credit card with BofA. I have used their online service to make my payments. They did not post my payments in a timely manner, and now they are charging me 30% interest on my balance. I transferred some of the balance to lower interest cards. They did not post the transfers timely either. I paid interest on the same money to two different credit card companies, for 8 days the first one and about 14 days on the second one. This should be illegal. I think it is, and so does my attorney. If anyone out there is interested in getting in on a class action lawsuit, please contact me.

The complaint has been investigated and resolved to the customer’s satisfaction.

I don't even do business with them but made the mistake of giving them permission to take a one time payment out of my checking account for my fiancee's credit card payment.needless to say they stole my money today and when I tried to call them of course I got transferred by a live person to a recording!they have been trying for 3 months to take money out of my fiancee's account that has been closed for the 3 months and we have told them this until we are blue in the face!

an inaccurate past due amt. on loan

Countrywide is showing we have a past due (30day) amount of $1, 208. We were approved for a loan modification on Acct#[protected]. The new payments are $1585.24 @ 3% interest for 5 yrs. The amount they say is overdue is the old loan monthly payment of $1, 208. The paper work we have shows the restructured amount was approved for September 1, 2008 through Aug.1.2013. We have called and called to try and tell them we have the approved paperwork for the new amount that we HAVE BEEN PAYING ON TIME EVERY MONTH, yet they are charging us late fees on the old amount. Please fix this. Thank you.

The complaint has been investigated and resolved to the customer’s satisfaction.

loans and service

Well, where to begin. We had excellent credit- we purchased a home in 2002 in Missouri. Our first mistake was Countrywide. We were in formed in 2006- that we should have never gotten our loan due to ineligible house. At that time we wante to know why- apparently the apprasial company (they hired) had not put info in the first apprasial when we purchased the home ( a mobile home wall still existing in the walls). We know that they knew, because the apprasial people knew about the home when they did that "BAD" apprasial -we got that from the horses mouth themselves.

So, we got the loan no problem cause our credit is great. Only to find out when we tried to sell the home- that no lender, not even Countrywide- would give a loan to ANYONE on our house! no banks would touch it because of the apprasial problems. Needless to say- through tears- 8 months...went by. I had people who loved the house- regardless of that mobile home wall - it had 5 ac, big shop- beautiful land...but no one would help us. We couldn't find a lawyer with guts enough to help us, though we have all our paperwork- all the headaches documented.

we decided to do what they call a deed in lieu- which is to basically give the house back to the bank- all our hard work and money LOST! They acted like that it would work that way- they drug that out for months- only to loose, shred or misplace documents (so we were told ). Our file was juggled around through several incompetent people- and we got josteled around so much it was sad. We got treated like all this was our fault...

I had had enough- I left the house to go be with my family. It is still being drug out...we have told them just to foreclose it...and leave us alone. They have set a foreclosure date- and that has changed a few times since our notice. Everyone who calls us has NO IDEA what has gone on, nor do they care. They ripped us off, ruined our credit, and fiancially hurt us- we were expecting to sell a home...get some cash for our next home...now- we are renting cause we don't know what they are going to pull on us, this clearly is a case of lies and deceat on their part- and this is only part of the story...there are plenty of details and problems with them that I left out.

please...if you are looking to buy a home- do NOT use Countrywide!

If there is a lawyer out there willing to help us or know someone who will- please let us know. Here are 2 numbers you can reach us by. [protected] 0r [protected]

thanks for listening

The complaint has been investigated and resolved to the customer’s satisfaction.

You must consider a shortsale most people do not realise that the bank does not care about the homeowner and there are millions of boiler room scams offering loan mods popping up every day . Out of 4 million homeowners facing foreclosure only 135, 000 have been helped thru a modification, companies are no longer allowed to charge for modifications so anyone offering their services at a price is a scam . I suggest talking to a licensed real estate agent about your case.

www.romanrealtors.com

also many people do not qualify for the 5 requisites the bank requires .

we do not charge for modifications or shortsales the bank pays us. We wont ask u for a dime.

Joaquin Roman

Owner

Roman Realtors and Financial Services, Inc

3005 S. Bristol

Santa Ana, CA

http://romanrealtors.com/

[protected]

They had my wife re-mortgage our home without my consent, and they put her in a program that increased our mortgage payments up, up up every 6 Months, i finally got out with another bank who in turn sold me right back to them, Now i have had a triple bypass and send only what i can, limited funds, now on SSI, reported it to them and now they just say to me, or send letters saying, we are in the process of foreclosing on your home, wow what a Bank, they should be sued, anyone want to start a Class action lawsuit please contact me here and lets all get together and start one.

As far as the Government, why can't they do something about this... with all the complaints the US Government should do something.

overcharged

That's right, another complaint concerning overdraft fees with Bank of America (BOA). Before you naysayers rise up against me, let me first tell you that I did not monitor my account or my spending as closely as I should have. Now with that being said, let me say this. My checking account was -$136 (negative). After discovering this, I immediately...

Read full review of Bank of America and 56 commentsbad customer service

During the week of 8Dec2008, I had a notice of insufficient funds notice on my account. I went to the bank and atm machine to make a deposit to get the account out of the red. I later learned there was still another transaction pending that would keep the account in the red. I called customer service and I told them that I was expecting some money the...

Read full review of Bank of America and 11 commentscrazy fees

I had a check to cash from Best Buy for $300. I went to Bank of America (where Best Buy do thier banking) to cash the check. I do not have a checking account with Bank of America.

They wanted to charge me $6 to cash a check drawn from thier bank!

How dumb is that.

With all the banks asking for a bail out, you think Bank of America would be helping people. Now they create a dumb policy to stick it to the customer one more time.

Close your Bank of America account today before you have to write a friend a check. They will name them too!

The complaint has been investigated and resolved to the customer’s satisfaction.

bank of america charged me at first five dollars for insufficient funds and then thirty five for ten days of extended period

cancelled without notice

We have always paid our bills on time and in full. However, after relocating to California as a business promotion 2 years ago my husband was fired in March 2008 from his employer after 12.5 years of service with nothing but 6 weeks of vacation pay because the company was filing chapter 13 due to the economy. While we have been fortunate to make a good living we now own a home worth $400K less than the purchase price and as of December have run through most of our savings to try and keep our home. My husband is self-employed making half the money but we have stayed current on every bill and even paid 2X the minimum trying to get credit cards paid down. We have been late 3X on our mortgage, over 30 days but no more than 35 days due to cash flow. However, we have NEVER< EVER been late on any other bill. Last week I received notice that one card, which we had paid down by over half owed, was lowering our credit availabilty...to just $200 over what we owed...the lowered it over $6K...FINE but doesn't that hurt my credit further? Now BOA is has just sent a notice that they are cancelling our line of credit but thankfully it is a fixed rate and they just have to wait for us to pay it down. However, that again is going to damage our credit. While we should be able to pay all of these creditors off in the next 6 months our credit has been TRASHED...and by nothing we have DONE or DESERVED as consumers. I feel like a noose is slowly being tightened around us and wonder why we should keep trying to "DO THE RIGHT THING". Why are we bailing out banks when they are taking our money and RUINING everything we have built financially? There has to be some type of LAW during times of extremem crisis, like now, that would prevent these vultures from feeding on WE THE PEOPLE! It is not right. It is wrong. It is time someone did the RIGHT THING in OUR GOVERNMENT to be here for WE THE PEOPLE>...what is wrong out there?

The complaint has been investigated and resolved to the customer’s satisfaction.

1txgal...I feel your pain because the exact same thing was just done to me by Bank of America. They reduced my credit card credit line by $11, 000 to where it is now only a few hundred dollars above my limit. This was done despite the fact that I have never paid late nor have I gone over my limit in the 6 years I have been a customer. I spent about 3 hours on the phone with them, but to no avail. Their justification is that I was unemployed because I just graduated (a few weeks ago, mind you) and was awaiting my bar results to be able to practice law. I explained that that should have made no difference because I always paid more than the minimum payments, even when I was out of school, and that they have no legitimate justification to all of a sudden cut my credit line by half. I am furious because this will surely hurt my credit score since I am now close to the limit (while before I was below 50%). The only thing I got from BOA is that I should call back in 6 months after I have made more aggressive payments (even though I already pay well over the minimum payment each month). I have been a BOA customer for 8 years now and am seriously considering closing all my accounts because this is ridiculous. They should not be able to get away with this!

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

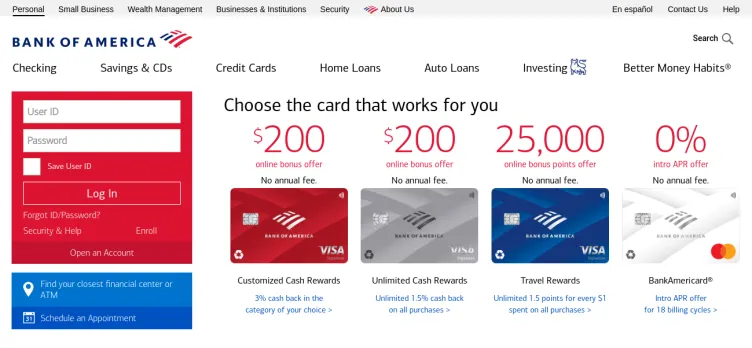

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 1 1 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number88%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreDec 19, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreDec 19, 2024 - View all Bank of America contacts

Most discussed Bank of America complaints

ATM security firm illegal in nycRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.