TaxAct’s earns a 1.4-star rating from 62 reviews, showing that the majority of users are dissatisfied with tax filing experience.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Can't reach taxact

I've used TaxAct for many years with exceptional service. As of today, March 6,

2022, I keep getting an electronic run-around. When I call, nobody takes the call. An electronic voice says to click an icon on the top right corner of my screen. There is no such icon on my form. TaxAct Chat says it is unavailable. An e-mail to "support" gets a no-reply response that that service no longer is available.

Specific problem: I'm looking at itemized deductions. There is a huge mistake in the amount of medical costs. When I try to change that figure, I'm told I cannot do so and still file electronically. Also, there is no place under "miscellaneous deductions" to list the cost of having a trust fund that produces income.

Desired outcome: I just want somebody to take my call or chat.

No support for previously filed online returns

1. I am Taxact user for the past 12 years and have filed online state and federal taxes every year.

2. I am filing taxes for two States namely MA and VA being nonresident in MA.

3. The Software always ports data from Federal to State return. Somehow it was porting income to both States for tax purposes. When I asked a question 10 years back. I was told that you will get Credit in the other State taxes.

4. I kept on doing this and never any error was reported during the audit before filing the online taxes.

5. This year Taxact started providing free tax review before filing and I was told my MA return was incorrect and she helped me in correcting it.

6. During past 10 years starting 2010 I have overpaid nearly $20,000 in MA taxes. I asked how I can correct it. Her reply was we provide support for 2021 taxes only.

7. She was right. I searched the entire site and the web, there is no phone number available even to call or make complaints about the error.

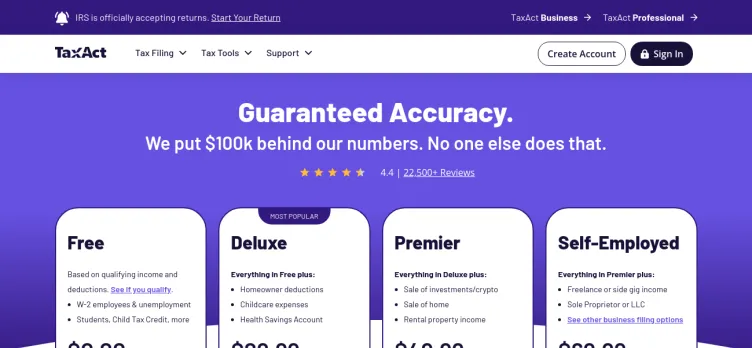

8. The Taxact guarantees $100000 for software mistakes. They do not provide any help and even you can't find any customer service help.

It is very frustrating, and I am thinking of seeking some legal help.

Desired outcome: I would appreciate it, if they provide some help to resolve this or honor the guarantee .

Online taxes for year 2021

I went to TaxAct to do my online taxes and needed the premier version which was 37.99 counting tax. Ok, so far so good as I had crypto to pay tax on.

BUT when at the very end when it came time to pay, it offered me a choice to take it out of my refund. Well, seems the easiest so I said yes.

BUT the total on top of the 37.99 was a 54.00 fee from Republic bank for something like transfer fees to deduct it out of my refund! REALLY?

So I was at the point to hit "pay" and thought I might try it just paying from my own credit card and there ya go, 37.99 total price to pay.

TaxAct might not be crooks but it says a lot about them to even use a back that would charge this outrageous charge just to deduct it from your return. Gees!

The Whole Company

I never dealt with this company; I get a text for my one tome login verification. That concerned me. Was someone trying to steal my I, D. or trying to file a false tax return in my name. I called on Saturday Feb 12, I was on hold for 45 minutes, I finally hit one to hold my place in line and get call back. Well this Monday Feb 14, and never got one back. I called again and the recording said it could not accept my call. It says use the website. The website says call. I am not creating a account just in case if is someone trying to steal my info. Alll i wanted to know if someone is trying and have the company delete any info they have on me. Worse service, can not contact them by phone. If they were trying to get my business, they just lost that

Desired outcome: contact ma A.S.A.P,

Scam

Through the irs.gov free file, I used taxact this year as I did last year. My wife and I filed jointly with a gross income of just over $70,000. After over 3 hours of trying to get everything right, Taxact hit us with a fee of almost $100 claiming we were above the free file threshold. If this even was the case, which it should not be since we easily made less than $65,000 per person, they waited until the end, again over 3 hours later to charge us. This is at the very least unethical, and possibly illegal.

Desired outcome: I would like a refund and penalties enforced upon Taxact

2021 tax software program

Have used Taxact for the past 10+ years. This year again I filed with Taxact. On completion, TA setup a voucher that I owed $4165 which I sent in to the IRS with payment. The other day I received a letter from IRS stating I underpaid some $486.27. Upon reviewing the return I saved, it appears that Taxact program did not take into consideration that I wa...

Read full review of TaxActNo customer service / scammed / want to delete account

I've been trying to reach TaxAct for weeks but I cannot get to them by phone nor will they return my emails. I used the email from the Contact Us page. I started to use chat but they want to look at my computer and I'm not willing to give anyone that access.

The problem is that twice I received a one time authorization code that I did NOT generate both in a text and an email which means someone has accessed my sign in information and tried to get into my account. The first one was on June 21st and the second was on June 23rd. I'm franticly trying to get this resolved but to no avail.

I've decided to delete my taxes and my account but cannot find any way to do that. The online help does not work as they indicate in their online help pages.

Desired outcome: I want CURRENT steps (not something from the past that no longer works on this site) to delete my account in total. Ideally if someone could contact me to walk me through the steps but not chat as I do not want to do a screen share.

Lost a paid for tax return.

03/09/21:

I have been filing my taxes with Tax Act since 2017.

We are currently purchasing a home and needed the last 3 years of returns. One of my returns; for 2018 was lost. I stood on the phone for hours; sent from one center to the other. One tech support said it simply slipped through the cracks. The system did not save my return and there is nothing they can do about it. Not a letter/ email, nothing they could do to help me... to try going through the IRS (5-10 days) to find my returns. I feel like if I purchased through TaxAct it should be a secure place not only to file taxes but to save and view previous returns. If my tax return simple slipped through the cracks of the system, will it not happen again?

-Lauren Garcia

Username: taxes2017L

Desired outcome: Refund, or help finding my return in a timely manner.

Cannot Delete Account

I have fallen victim (like many other reviews I've read here) to thinking that I could file my taxes for FREE. Only to get to the end to tell me that I have to pay a fee. While the inconvenience of this was highly annoying, it's not what really ticked me off.

For some reason I CANNOT delete my user account from their website, I can only "manage/update" my personal info. Now all of my sensitive information is actively floating around in their database. It is for this reason I will never use this site again.

The least Taxact (2021) can do is allow me to break free from them after having deceived me.

Desired outcome: Allow a customer to DELETE their account.

Free Tax Act online

I usually use TurboTax, but last year, I thought I'd try this. DON'T! It's a complete rip-off! Halfway through a simple tax return I've been doing myself with TurboTax since 2004, I got hit up for a large fee 'because the return was more complicated'... Baloney! How can a return with 1099's and dividend income be 'more complicated'? I'm a retired, disabled widow. With the higher personal deduction, I didn't even itemize!

I got out of there as fast as I could. This was for 2018.

I'm appalled that IRS recommends this service. It's a total scam. Find Turbo Tax with State return (if applicable) for $50 online. It's well worth it.

TurboTax has 18 pages of complaints and it is worse this year than last year.

poor customer service & support

I've used TaxAct for years. I'm a professional preparer and left TaxAct, for another software provider, because of price increases every year. In addition, when requesting support, often because the software wasn't calculating correctly, it could take two days, for a response. When I tried to negotiate with the sales rep, Marianne, she was sarcastic and...

Read full review of TaxActunethical behavior

My most recent TaxAct experience (04-15-2019) has been terrible and I hope thousands of people find this helpful and choose to do their online taxes elsewhere. TaxAct has put me into a continuous loop for payment. I had already gone through the Basic version and only needed to e-file and print the payment voucher, however, TaxAct would not allow me to proceed unless I paid for the Deluxe version upgrade. That, by the way, is extortion. Out of sheer desperation, I paid for the Deluxe version, which was $32 just to be able to e-file and print the payment voucher. However, TaxAct will still not allow me to e-file nor will it allow me to print the payment voucher. TaxAct wants me to pay for the Deluxe version again. At this point, I am going to have to print the View Only summary and get a blank 1040, fill in the information, send in all applicable forms with it and the payment. In conclusion, TaxAct is horrible and I will never use it again! -ronaldmccraw

Gift card scam

I opted for part of my refund to be given on an Amazon gift card. I checked with Republic Bank who told me they forwarded that money to TaxAct on Feb 15 and to this date, March 8, I have not received it. No answer from giftcard@taxact.com for several weeks. No answer from Assistance@taxact.com for several weeks. If you call the customer service number 319-373-3600 the message says to email giftcard@taxact.com, but they do not respond at all - even to say they received the message and are working on it. Just silence. I can't get a live person on the phone. Republic Bank can't help any more. I'm afraid this has all been a Tax Act scam and my family just lost over $500.

In their defense, they did file my taxes and the rest of my refund went down as promised - the gift card situation is my only complaint. I've used TaxAct several times before this and had no issues. There is nothing "free" here - this was part of my refund.

software downloads

Your offices are closed but, you website says you should be open

January (mid-month) — April (through IRS deadline)

Monday - Friday 8am - 8pm

Saturday 9am - 5pm

Sunday 10am - 5pm

My complaint is that I cannot down load the State of Kansas tax forms. I called a week or so and they said they should be ready, but still says coming soon. I have been using your software for many years then now this. Help with this or I need to get refund I have several people that I cannot do because of this.

James Erwin

Harrisonville MO

online tax preparation

I was attempting to file my daughters taxes with taxact Wendy L Oliver [protected] and was charged 34.95 instead of 9.95. The I tried repeatedly to e file and never successfully transmitted her taxes. I finally filed with another provider but was still charged $34.95. I have spent all day trying to contact taxact to rectify this situation but to no avail.

basic vs. plus online edition

4/15/2018

My return is a 1040A but I am being charged for 1040 at the plus rate, and will have to pay too much for the state return. Why can't I change back to the Basic rate with reasonable rates for federal and state?

Also, there was no easy way to email TaxAct if not using gmail or yahoo. The email account for the company was not displayed, it was only a link type.

online filing

The IRS never received my 2016 return. According to TaxAct, I didn't finish clicking various buttons to e-file. I know I went all the way through the process. I have a copy of the return. I paid what I owed through a 3rd party online. TaxAct took my money as well. Now they say it's my fault! I'm out $27 and may be facing penalties for late filing! All they can say is I have to mail it in!

federal income tax software

Here is my experience with Tax act bait and switch. You can get a refund of upgrade cost also!

Original Message

From: "greengroth"

Date Received:4/17/2016 8:32:04 PM

To: ""

Subject:Trash Act

I buy the basic edition and find after completing my return I must buy the premium edition. That is UNETHICAL. BAIT and SWITCH!. Then all the NAGS for upgrades and state programs. Very annoying when concentrating on my taxes.

I will let everyone know Tax Act is now a rip off and stay with better options.

------------------------------------------------------------------------------------------------------------------------

On 4/18/2016 1:12 PM, [protected]@taxact.com wrote:

This year, TaxAct introduced a new product line designed to provide customers with a more personalized experience based on each person's unique tax situation. Our new products include different tax forms, schedules and worksheets specific to those tax situations. Although you started a TaxAct Basic return, your tax situation requires at least one IRS tax form, schedule or worksheet that is not included in Basic but is included in Premium. The form(s) that your tax situation requires was listed on the screen where you were given the option to upgrade to TaxAct Premium or proceed with the product you had.

We encourage you to compare TaxAct to other major brands. We are confident you will find that TaxAct is the best deal in tax at a fraction of the cost of other major brands.

If you have specific questions about your fees or our products, please feel free to reply to this email.

Sincerely,

Jessi D.

TaxAct Customer Service

-----------------------------------------------------------------------------------------------------------------------------

[protected]@toast.net is my tax act username

On 4/18/2016 2:58 PM, [protected]@taxact.com wrote:

We do not want customers to have the impression that we utilize "bait and switch" tactics. I am happy to research your situation to see why you were required to upgrade. Please reply to this email with your TaxAct Account username, as your email address of xxx is not in our system.

Sincerely,

Jessi D.

TaxAct Customer Service

-------------------------------------------------------------------------------------------------------------------------------------------------------------

________________________________________

From: "greengroth" Date Received:4/18/2016 4:48:28 PM

To: ""

Subject:Re: Trash Act[6253353:6322551]

I may have been given the option after i purchased basic. Too late, for I didn't have an opportunity to shop for other tax programs after I spent money on basic.

I in fact was a victim of your 'bait and switch'. I had to upgrade at the last minute to be able to file. I've always used Tax Act Basic and it did the job.

I expect the charge of $20.00 to be removed from my credit card ASAP.

Thomas W.Schroeder

Your TaxAct order number [protected] has been refunded in the amount of $20.00. Please allow up to 15 business days for the credit to post to your account.

If you have questions concerning the billing of your account, or believe you have received this email in error, please contact Customer Service via e-mail at [protected]@TaxActService.com.

Customer Service

TaxAct

[protected]@TaxActService.com

Below is my purchase receipt for basic.

Order Summary

Product Format Qty. Unit Price Total

TaxAct 2015 Basic Edition Download 1 $19.99 $19.99

No State Income Tax Download 1 $0.00 $0.00

Sub-total $19.99

Tax $0.00

Grand Total $19.99

This is for the required upgrade to file my taxes

Billing address:

THOMAS SCHROEDER

Order Summary

Product Format Qty. Unit Price Total

TaxAct 2015 Basic to Premium Upgrade Download 1 $20.00 $20.00

Sub-total $20.00

Tax $0.00

Grand Total $20.00

Billing address:

THOMAS SCHROEDER

tax filing software

I started using Tax Act free but couldn't continue because it didn't support Schedule C. There is no option to delete an incomplete return or account. Online help suggests that this used to be an option but no longer. Company representative in response to a customer complaint advises to go in and enter invalid information to avoid identity theft risk. This is a poor solution. Given the risks for any online service to be hacked, not allowing a customer to delete their incomplete return or their account is a very bad design. I will not use Tax Act again.

they took fee for the late payment. scam.

I used the website www.taxact.com in order to prepare all the documents. The company asked me to fill too many papers and documents; afterwards they said that I could pay in the end of our deal. So, when everything was ready, the rep said that I still didn’t pay for the services and therefore they would ask me to pay for late payment. The fee wasn’t large...

Read full review of TaxActTaxAct Reviews 0

If you represent TaxAct, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About TaxAct

Here is a comprehensive guide on how to file a complaint against TaxAct on ComplaintsBoard.com:

1. Log in or create an account:

- Start by logging into your ComplaintsBoard.com account. If you don't have an account, create one.

2. Navigating to the complaint form:

- Locate and click on the 'File a Complaint' button on the ComplaintsBoard.com website. You can find this button at the top right corner of the website.

3. Writing the title:

- Summarize the main issue with TaxAct in the 'Complaint Title'.

4. Detailing the experience:

- Provide detailed information about your experience with TaxAct.

- Mention key areas of concern.

- Include any relevant information about transactions with the company.

- Explain the nature of the issue.

- Describe steps taken to resolve the problem and the company's response.

- Share the personal impact of the issue.

5. Attaching supporting documents:

- Attach any additional supporting documents that can strengthen your complaint. Avoid including sensitive personal data.

6. Filling optional fields:

- Use the 'Claimed Loss' field to state any financial losses.

- Utilize the 'Desired Outcome' field to specify the resolution you are seeking.

7. Review before submission:

- Review your complaint for clarity, accuracy, and completeness before submitting.

8. Submission process:

- Submit your complaint by clicking the 'Submit' button.

9. Post-Submission Actions:

- Regularly check for responses or updates related to your complaint on ComplaintsBoard.com.

Ensure each step is clearly defined to guide you effectively through the process of filing a complaint against TaxAct on ComplaintsBoard.com. Remember to focus on issues related to TaxAct's business category.

Overview of TaxAct complaint handling

-

TaxAct Contacts

-

TaxAct phone numbers+1 (319) 373-3600+1 (319) 373-3600Click up if you have successfully reached TaxAct by calling +1 (319) 373-3600 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 373-3600 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 373-3600 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 373-3600 phone numberCustomer Service+1 (319) 731-2682+1 (319) 731-2682Click up if you have successfully reached TaxAct by calling +1 (319) 731-2682 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 731-2682 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 731-2682 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 731-2682 phone numberProfessional Customer Service+1 (319) 731-2680+1 (319) 731-2680Click up if you have successfully reached TaxAct by calling +1 (319) 731-2680 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 731-2680 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 731-2680 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 731-2680 phone numberProfessional Tax Help+1 (319) 536-3571+1 (319) 536-3571Click up if you have successfully reached TaxAct by calling +1 (319) 536-3571 phone number 0 0 users reported that they have successfully reached TaxAct by calling +1 (319) 536-3571 phone number Click down if you have unsuccessfully reached TaxAct by calling +1 (319) 536-3571 phone number 0 0 users reported that they have UNsuccessfully reached TaxAct by calling +1 (319) 536-3571 phone numberSales

-

TaxAct emailsassistance@taxact.com100%Confidence score: 100%Supportmelanie.milton@taxact.com94%Confidence score: 94%Operationselvis.bernauer@taxact.com94%Confidence score: 94%Operationssarah.crouch@taxact.com93%Confidence score: 93%Operationsgreg.detweiler@taxact.com93%Confidence score: 93%Operationsstephanie.blood@taxact.com92%Confidence score: 92%eric.ballew@taxact.com92%Confidence score: 92%Operationsprosales@taxact.com91%Confidence score: 91%Communicationpr@taxact.com91%Confidence score: 91%Communicationsupport@taxact.com85%Confidence score: 85%support

-

TaxAct address1425 60th St NE, Cedar Rapids, Iowa, 52402-1284, United States

-

TaxAct social media

-

Checked and verified by Nick This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreMay 24, 2024

Checked and verified by Nick This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreMay 24, 2024 - View all TaxAct contacts

Recent comments about TaxAct company

Free Tax Act onlineOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.