I Q Credit Union’s earns a 1.1-star rating from 14 reviews, showing that the majority of members are dissatisfied with banking services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

I don't understand why I keep getting kicked out of my account when I try to log in

I don't understand why I keep getting kicked out of my account when I try to log in. Is there something wrong with your system or is it just me? It's really frustrating and starting to annoy me. Can you please fix this issue? Thanks.

My hubby and me, we joined IQ Credit Union afore they gobbled up Columbia Credit Union

My hubby and me, we joined IQ Credit Union afore they gobbled up Columbia Credit Union. Ever since that takeover, the customer service has gone downhill each year. I can't even keep track of how many times we've set up auto payment for our wheels loan and been in good standing, only to receive a past due notice in a matter of months (even though there's money in the account). When I ask 'em about it, they either say there's no record of this bein' an issue or that we've only had auto payment for a few months. After gettin' the latest "past due" notice, we've decided to take our finances elsewhere and pay off our wheels loan from there.

I've been with this credit union for 'bout 40 years

I've been with this credit union for 'bout 40 years. 'Bout 4 or 5 years ago, I opened some savings accounts to match the money my grandkids put in. I was in charge of managing and balancing these accounts. So, I wanted to print 2 of the account balances to PDF, but suddenly I couldn't access 'em anymore. Those tech folks changed it so my grandkids could sign in, but I couldn't. My grandkids don't even sign in, they don't know how much money is in the account. After over an hour on the phone, they told me I gotta go in with their legal guardian, one of their parents, and sign some forms to get back into the account. It seems to me that if they could set it up with me 4+ years ago and I've been managing it all this time, they could just fix their mistake. But nope, they're happy to inconvenience their members 'cause they can't communicate properly. I'm pretty sick and tired of their inconveniences. Richard

I Q Credit Union Complaints 11

I got a tough credit inquity on my credit file

I got a tough credit inquity on my credit file. I don't know about this company. This hard inquiry happened today, 10/30.

Iq credit union needs to pay somebody to reset their server on Sundays or update their server

Iq credit union needs to pay somebody to reset their server on Sundays or update their server. I go online to transfer money from checking to savings and the only option is to transfer from IQ checking to external account.

I had a problem with this awful credit union that I regret joining

I had a problem with this awful credit union that I regret joining. They won't handle my fraud dispute and won't even reply to me. They keep telling me to call a number, but no one ever answers. I think it's because I'm Mexican and they're racist.

Is I Q Credit Union Legit?

I Q Credit Union earns a trustworthiness rating of 91%

Highly recommended, but caution will not hurt.

We found clear and detailed contact information for I Q Credit Union. The company provides a physical address, 5 phone numbers, and 2 emails, as well as 5 social media accounts. This demonstrates a commitment to customer service and transparency, which is a positive sign for building trust with customers.

The age of I Q Credit Union's domain suggests that they have had sufficient time to establish a reputation as a reliable source of information and services. This can provide reassurance to potential customers seeking quality products or services.

Iqcu.com has a valid SSL certificate, which indicates that the website is secure and trustworthy. Look for the padlock icon in the browser and the "https" prefix in the URL to confirm that the website is using SSL.

Iqcu.com has been deemed safe to visit, as it is protected by a cloud-based cybersecurity solution that uses the Domain Name System (DNS) to help protect networks from online threats.

Several positive reviews for I Q Credit Union have been found on various review sites. While this may be a good sign, it is important to approach these reviews with caution and consider the possibility of fake or biased reviews.

We looked up I Q Credit Union and found that the website is receiving a high amount of traffic. This could be a sign of a popular and trustworthy website, but it is still important to exercise caution and verify the legitimacy of the site before sharing any personal or financial information

However ComplaintsBoard has detected that:

- While I Q Credit Union has a high level of trust, our investigation has revealed that the company's complaint resolution process is inadequate and ineffective. As a result, only 0% of 11 complaints are resolved. The support team may have poor customer service skills, lack of training, or not be well-equipped to handle customer complaints.

- I Q Credit Union protects their ownership data, a common and legal practice. However, from our perspective, this lack of transparency can impede trust and accountability, which are essential for establishing a credible and respected business entity.

- We have identified high risk financial services or content on I Q Credit Union's website. It is recommended that you use trusted sources and do your due diligence before engaging with any offers or services.

Iq credit union asked me to verify micro deposits sent to and from twin star

Iq credit union asked me to verify micro deposits sent to and from twin star. Iq credit union sends six different micro deposits and asked me to guess which two of the six they send. Real Dumb! I guess the last two which were the most recent in the *** rejects the deposits. *** does not answer their phone nor has a message system on their website.

They keep chargng me a return mail fee when my address is correct

They keep chargng me a return mail fee when my address is correct. If they want to verify, they can come to my house. I have no control over *** stupidity. This is BS, my address is correct. They are just as bad as a BANK. I don't want any mail from these clowns if they charge ***, and I have already told them this. IQ is a bad company chargng you because a mail carrier is ***.

They sold me unemplyment insurance on my auto loan

They sold me unemplyment insurance on my auto loan. When I lost my job, they did not honor the insurance. Repossessed the vehicle, and presented me with a *** for the balance. I would like to get my truck back, have the payments on the policy honored, resume making my payments, and have the derogatory credit removed from my credit report. IQ did me dirty, they need to make this right.

I got this checking account that was supposed to be closed

I got this checking account that was supposed to be closed. I've been with this credit union since ***. By mistake, they tried to charge from this account that I left behind, and now IQ credit union wants $180 for fees. I called them to fix it, but they won't budge on reversing these charges. I can't afford this or a lawyer to fight them, so they'll ruin my credit instead of doing what's right.

I'm a member at IQ and my 2500 card got shut down

I'm a member at IQ and my 2500 card got shut down. My score dropped drastically. I could see it if I had a huge limit or even lowering my limit, but no, they shut it down. I have NEVER been late or missed a payment. I was close to my limit and had just put 300 on my card, keeping this little line of credit up to date. This is poor practice. I want others to know this isn't a place to settle in with. I have a rather large amount of retirement opening in 2022. This will not be my bank.

I bought a truck in July and got approved for my loan through IQ Credit Union

I bought a truck in July and got approved for my loan through IQ Credit Union. They gave me a 3-month extension, so my first payment wasn't due until the end of October. Unfortunately, my truck has been in the shop since the beginning of October, and I've had some personal issues that caused me to be out of work for a month. I was hoping my truck would be fixed when I returned, but it's still not, which means I don't have a vehicle to get to and from work, and I ended up losing my job.

Now it's November, and my truck has been transferred to a different place, but it's still not fixed. I called the credit union, and they extended my payment deadline until January 5th. However, my truck is still not fixed at the moment. I have until Monday, January 23, 2023, to make my first payment. If I don't, they will repossess the truck that I'm not even driving.

I've pleaded with them to help me by pausing my loan or finding some other solution, but they refuse to assist me any further. Losing my job also led to my phone being shut off, making it difficult for me to contact the jobs I've applied to. I really need help because it doesn't seem fair that I have to make payments on a truck that I haven't had for 5 months.

After being a member for 10 years and consistently paying off loans ahead of schedule without ever missing a payment, you would expect to see an

After being a member for 10 years and consistently paying off loans ahead of schedule without ever missing a payment, you would expect to see an improvement in your credit score and receive positive recommendations. However, the credit card application process at I Q Credit Union was incredibly invasive. I had to provide an excessive amount of personal information, more than I have ever had to give to any other company. Despite spending countless hours and days trying to correct their constant misinterpretation of my information, I was still DENIED! (Interestingly enough, I was approved for another bank within just 5 minutes of calling them).

To put things into perspective, I earn nine times the amount of my rent (which is already very low). I asked if my additional income could be considered, to which the response was, "I didn't realize you had another source of income." It's worth noting that I was never asked about additional income during the application process. They simply stated that "my income falls outside of their loan guidelines." In an attempt to prove my financial responsibility, I asked them to review all the loans on my credit over the past 2-3 years, ranging from $200 to $6,000, all of which I paid off in full. Their response? "We don't see any loans on your credit." However, in the very next message, they contradict themselves and say, "Considering your rent and all other loans on your credit, along with the new loan from us, your income falls outside of our loan guidelines."

Even though I provided paystubs and legally signed documents, it still wasn't enough for them. I have two sources of income from the state, and even the state officials were perplexed by the excessive amount of information required. They had never encountered such invasive documentation, except in court cases. The amount of personal information I had to provide is enough to compromise my entire identity if there were ever a data breach or if the staff mishandled it. It's unsettling to think that they required so much information, especially considering the lack of competence displayed by their illiterate staff. They refused to acknowledge my actual pay and recorded it as $1,000 less than what was stated. They also failed to understand the concept of withholding taxes, both taxed and untaxed. Furthermore, they refused to accept my W2 form.

On another occasion, I fell victim to a scam, and their response was to lock all of my access for several months, stating, "We can't be sure if it was you, so we're taking this precautionary measure. If you can prove your trustworthiness over time, we will gradually restore your access, one by one."

Overall, my experience with I Q Credit Union has been disappointing and frustrating. The invasive application process, the lack of understanding regarding income and loans, and the questionable response to security concerns have left me feeling uneasy about continuing my relationship with them.

I applied for a car loan with IQ Credit Union and they approved it

I applied for a car loan with IQ Credit Union and they approved it. The plan was to deduct the monthly payments from our shared checking account, which belongs to my wife and me. Since it was a reverse loan, where I borrowed money against a vehicle I owned outright, the loan amount was also supposed to be deposited into the same account. However, a few days later, I noticed that the money hadn't appeared in our account. So, I reached out to IQ Credit Union and spoke to the manager, who goes by the name of *** or ***.

She informed me that the money had been deposited into the wrong account and assured me that she had made the necessary changes. I then asked her if this meant that the payment would also be deducted from that account, to which she replied affirmatively, explaining that it was how the setup worked. I disagreed, stating that it shouldn't be set up that way, and she proceeded to correct it. She also mentioned that she would set a reminder to fix the due date, as it was currently set for three days after the actual due date.

At that point, I thought everything would be resolved. However, I received a letter from IQ stating that I was late on the loan payment. I couldn't understand how this was possible if the payment was set to be made automatically. It crossed my mind that maybe *** hadn't followed through with her promise to change the date. So, I returned to IQ to sort things out.

The original loan officer, ***, admitted to her mistakes and explained that she had rewritten the entire loan. According to her, this would be the first payment on the loan, and everything was now correctly set up with the due date and the correct account. I then expressed my concern about how this confusion might impact my credit. She assured me that it wouldn't affect my credit and that everything was in order. Once again, I was mistaken.

A few days later, I received a call from IQ asking when I planned to pay the overdue amount on my loan. I informed them that I had already made the payment through auto-pay and that *** at the Van Mall branch had made numerous mistakes with the original loan, leading to all these issues. However, I assured them that everything had been resolved. Unfortunately, my credit score has now dropped by 52 points, and I urgently need it to be rectified.

About I Q Credit Union

One of the key strengths of IQCU is its commitment to providing exceptional customer service. The credit union understands the importance of building strong relationships with its members and goes above and beyond to ensure their satisfaction. Whether you are opening a new account, applying for a loan, or seeking financial advice, IQCU's knowledgeable and friendly staff are always ready to assist you.

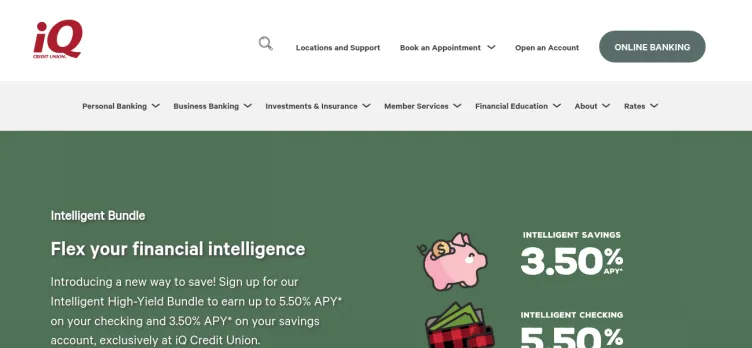

IQCU offers a comprehensive suite of banking products and services designed to meet the diverse needs of its members. From checking and savings accounts to loans and credit cards, IQCU provides a full range of financial solutions. The credit union also offers online and mobile banking options, allowing members to conveniently manage their accounts from anywhere at any time.

One notable feature of IQCU is its competitive rates and low fees. The credit union strives to provide its members with the best possible value, offering attractive interest rates on savings accounts and competitive loan rates. Additionally, IQCU keeps its fees minimal, ensuring that members can access the financial services they need without unnecessary costs.

As a member-owned financial institution, IQCU operates with the best interests of its members in mind. This means that profits are reinvested back into the credit union to benefit its members rather than being distributed to shareholders. IQCU's focus on member-centricity ensures that decisions are made with the goal of maximizing member benefits and enhancing the overall financial well-being of the community.

Furthermore, IQCU is committed to giving back to the community it serves. The credit union actively participates in various charitable initiatives and community events, demonstrating its dedication to making a positive impact beyond the realm of banking services.

In summary, IQ Credit Union is a highly regarded financial institution that offers a wide range of banking services with a strong emphasis on exceptional customer service, competitive rates, and community involvement. With a commitment to member satisfaction and a comprehensive suite of financial solutions, IQCU is a trusted partner for individuals and businesses seeking reliable and personalized banking services.

Overview of I Q Credit Union complaint handling

-

I Q Credit Union Contacts

-

I Q Credit Union phone numbers+1 (360) 695-3441+1 (360) 695-3441Click up if you have successfully reached I Q Credit Union by calling +1 (360) 695-3441 phone number 0 0 users reported that they have successfully reached I Q Credit Union by calling +1 (360) 695-3441 phone number Click down if you have unsuccessfully reached I Q Credit Union by calling +1 (360) 695-3441 phone number 0 0 users reported that they have UNsuccessfully reached I Q Credit Union by calling +1 (360) 695-3441 phone number+1 (360) 993-8725+1 (360) 993-8725Click up if you have successfully reached I Q Credit Union by calling +1 (360) 993-8725 phone number 0 0 users reported that they have successfully reached I Q Credit Union by calling +1 (360) 993-8725 phone number Click down if you have unsuccessfully reached I Q Credit Union by calling +1 (360) 993-8725 phone number 0 0 users reported that they have UNsuccessfully reached I Q Credit Union by calling +1 (360) 993-8725 phone numberMortgage Loan Officer+1 (360) 992-4242+1 (360) 992-4242Click up if you have successfully reached I Q Credit Union by calling +1 (360) 992-4242 phone number 0 0 users reported that they have successfully reached I Q Credit Union by calling +1 (360) 992-4242 phone number Click down if you have unsuccessfully reached I Q Credit Union by calling +1 (360) 992-4242 phone number 0 0 users reported that they have UNsuccessfully reached I Q Credit Union by calling +1 (360) 992-4242 phone numberSenior Vice President Marketing+1 (360) 992-4233+1 (360) 992-4233Click up if you have successfully reached I Q Credit Union by calling +1 (360) 992-4233 phone number 0 0 users reported that they have successfully reached I Q Credit Union by calling +1 (360) 992-4233 phone number Click down if you have unsuccessfully reached I Q Credit Union by calling +1 (360) 992-4233 phone number 0 0 users reported that they have UNsuccessfully reached I Q Credit Union by calling +1 (360) 992-4233 phone numberRegion Director+1 (360) 418-4471+1 (360) 418-4471Click up if you have successfully reached I Q Credit Union by calling +1 (360) 418-4471 phone number 0 0 users reported that they have successfully reached I Q Credit Union by calling +1 (360) 418-4471 phone number Click down if you have unsuccessfully reached I Q Credit Union by calling +1 (360) 418-4471 phone number 0 0 users reported that they have UNsuccessfully reached I Q Credit Union by calling +1 (360) 418-4471 phone numberMortgage Loan Officer

-

I Q Credit Union emailsmichael.booth@iqcu.com99%Confidence score: 99%dennis.nguyen@iqcu.com98%Confidence score: 98%Financedanette.lachapelle@iqcu.com98%Confidence score: 98%Marketingmelanie.josephson@iqcu.com97%Confidence score: 97%Finance

-

I Q Credit Union address1313 Main St, Vancouver, Washington, 98660-2918, United States

-

I Q Credit Union social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreAug 13, 2024

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreAug 13, 2024 - View all I Q Credit Union contacts

Our Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.

We have received your comment. Thank you!