Bank of America’s earns a 2.2-star rating from 1590 reviews, showing that the majority of banking clients are somewhat dissatisfied with financial services.

- All

- Reviews only

- Complaints only

- Resolved

- Unresolved

- Replied by the business

- Unreplied

- With attachments

Credit Card Account Closure

They closed my account due to "inactivity" (just paid the balance off 5 months prior) and "high balances/utilization" on other cards that have nothing to do with them. My payment history is excellent as I never miss a payment nor am I ever late. Just pissed off because it's Christmas time and I was literally getting ready to use the card. They can rot in hell.

closed my new account without notifying me

I opened a new checking account because my place of employment uses Bank of America and thought it be a good idea to switch. I did everything correctly online, received an account number, deposited a check via mobile check deposit to cover the opening fee. A few days later, I was trying to open my mobile banking app, and it wouldn't allow me too. So I called since I apparently "locked" myself out of the account and was informed by a customer service rep that my account was closed because they couldn't verify my identity and had to go into a branch to open an account with 2 forms of identity. I was more upset that I wasn't informed via phone, or email to contact the bank and I already set up my paycheck to go to this bank account, which I was informed that I would receive a notice in the mail, and have yet to receive anything informing me and now my mobile check I cashed at my bank was returned unpaid, along with their bank fee, for Dup presentment. I reached out to customer service today, which a lovely representative informed me that my account is finally getting closed today (what a coincidence) and funds will be sent out in a cashiers check within 7-10 business days, which leaves me without money until Friday when I get paid.

Desired outcome: Send me a check for the amount of the check they consumed of 522.12 and cover the $12 fee my bank charged me.

Fraud claim - back and forth with boa not paying attention to details

Someone at Spectrum, or some hacker, stole my debit card number and paid his spectrum bill with my card. I spoke to someone on the phone who clearly did not understand what I was trying to say about what happened. She did not enter it as a fraudulent claim but as a wrong charge claim. So, the claim was reviewed and denied.

Bank of America sent me the denied claim and reasons why which included the proof; a Spectrum bill with the charge that was taken from my debit card number and credited to this man's account to pay for his over-due bills. It included his name and partial address, who by the way lives in another state. Some genius in the claims department at Bank of America said it was a valid charge and closed my claim. The money was withdrawn from my account before I had time to provide proof of the fraud.

I submitted my paperwork to the bank in person to be faxed and they contacted me indicating that a Fraud claim would be opened. I received the temporary credit once again and I finally received a letter dated November 22, 2021 that the claim had been resolved in my favor. Mind you this all started in late August!

Today I looked at my bank account and noticed that the money had been withdrawn again! This time the message said it was closed and withdrawn from my account because it was a duplicate claim. WTH! I spent an hour on the phone being transferred once and talked to a guy who saw the very obvious error some idiot made in the claims department. He said it would be reopened by his manager but that would take 24 to 48 hours. So until then, I am out $234.48. I have to trust that someone will finally get it right and stop F'ing with my money and wasting my time. I don't much like wasting more time by making a complaint, but this whole process has been such a nightmare that I had to show the incompetence of some employees who work in the claims department at Bank of America. I am very close to taking my business elsewhere.

Desired outcome: Credit my account with the money that was stolen from me. Call Spectrum to get your reimbursement. They have the name and account number of the guy who stole my information.

I also had a terrible time with a Fraud complaint. Filed July14, 2021 after $20, 000 + was taken out of my checking account from January til July by someone who made an online account with my banking numbers. At first the Fraud Dept seemed competent. Sent out a copy of debits and I verified which ones were not mine and returned to them. Shortly there after they reinstated the money into a new checking account that they had me open. I had put on hold on the old account as they advised until I could redirect my direct deposit checks. They had the name of the person who paid his bills with my money but were not interested in going after him instead saying that Bank insurance would cover the Fraud and I should make a police report.. Fraud Dept employee told that the hold on the old account would expire and the account permanently closed on October 14, 2021. Of course the account didn't close. I called Fraud number as previously instructed and waited 39 minutes on hold before someone answered. That person knew nothing about account hold or supposed automatic account closing. I had just received a notice from the bank that the supposed closed account was now overdrawn with what I have no idea and they couldn't tell me either. I asked to speak to a supervisor or someone who knew what I was talking about. I was put on hold and supposedly transferred. After waiting another 20 min. I gave up! Now I have received 2 letters saying this account is overdrawn and I have until the end of the month to pay or they will report me to the credit bureaus. I have never received any communication from the Fraud Dept saying the investigation is closed or any other info from them. I have wasted a lot of time trying to deal with these incompetent people. B of A needs to get their act together!

Debit / credit card

You lost my renewal credit card, now I have to call all my merchants and issue a new number to them. I will be canceling my ties to your bank as of today and I hope you have a nice day in your world of deficiency of service. Ican no longer do buisness with you because of you lack of great service and wish to withdraw my monies and all ties to your firm.

Holds on checks that have cleared from other institutions

I placed a 1000 check in my account on 11/29 I was by the teller that there would be no hold funds would be available next day. When I checked my acct next day they put a 9 day hold on my check. I went into the branch to resolve my issue with a branch manager on Bustleton Ave in Phila and was told they could not help nor remove the hold. They also called back office and was informed that they were not sure as to why the hold was placed but could not remove the hold. I was told if I needed my funds immediately to have to check canceled by the payee. When I informed the payee of the scam BOA was running they immediately tried to cancel the check but was informed that the check was already cleared by BOA. SO IF BOA HAS MY FUNDS WHY ARE THEY REFUSING TO GIVE ME MY MONEY TODAY 11/30. This banking institution is a scam and I'm sure alot more customers are experiencing these issues. This account will be closed today and I will be reporting to the better business bureau of their negligence with assisting customers.

Visa credit card

I had a fraudulent charge of $49.95 on my card on 8/21 posting date 8/23/21 from LPRTSVC. neither the rep or me could find the company. Over the past several months I have talked with three different reps in their fraud department. They sent me a new card and held the transaction. Eventually they claimed I that it had been delivered which is complete [censored]. I asked they they provide me with a physical address and a description of what I allegedly ordered. About a month later they sent me a tracking number from USPS.

I know exactly what happened. I ordered a camera from a Home Depot scam (I do shop there often) for $6.95 shipping on 8/18. When I looked at the detail for the tracking number 92001901755477000679818185 the shipping label was created on 8/19 a day after I ordered the camera. I buy a lot of stuff online and have never had a vendor ship before they got payment. What happened was the scam shipped a camera for cheap then used the tracking number for that to 'prove' I had received the merchandise which was allegedly from 'Big House Muscle'. www.bighousehealthy.co. When you try and access the site it says' The site won't allow'.

The last rep I talked to said he fell for the same scam and the charge would be voided.

Card number ending in 1179.

Charge back case ID: [protected]

Desired outcome: I want the $49.95 fraudulent charge dropped as well as the $1.50 fee they added to my last bill. I would like to be compensated at my billing rate of $120 per hour - $720 so far.

Service

11-27-2021,

11:00 AM

My companies have a history dating back from Arizona Bank, to Security Pacific, and now B of A, some forty years or more.

I intended to make a deposit to my company account this morning at the B of A located at 9910 West McDowell Rd, Avondale AZ 85392.

First there was one teller behind a single window, four people ahead of me to make transactions. Bank personal were in and out of the main salon with no reaction to people waiting for a teller. When I left there were 17 people in line for that one teller!

I was ask if I need help with a deposit and went to a second terminal with a young lady. She took my deposit and deposit slip, stating that the amount was to large for her to authorize, left the main salon entering the back of the building.

I waited some thirty minutes or more when she returned stating they were trying to get authorization for the deposit. After another fifteen to twenty minutes a young man returned with my deposit stating he could not get authorization. I took the check, with deposit slip and left.

The amount of the deposit was and remains $1, 143609.53.

First it is deplorable that a bank would allow clientele to build up, additional representatives in plain site and knowing full well there are people standing in line, out the front door, and not caring to add counter personal, tellers, to remedy the problem.

The second question is why I could not make a deposit? I know first hand that the bank will hold my deposit for ten days, free usury, while they receive the funds directly from the other bank the same day? Every year I make a large deposit from this same company, and others, the bank holds the funds 10 days, even though B of A receives the funds from the other bank the same day as the deposit.

The reason I know this, is the company who's check I received and deposited has informed me their bank account was deducted the exact amount of the check they provided me on that very same afternoon that I made the deposit to my bank.

A simple enter bank transfer, via computer! Allowing ten days free usury!

Desired outcome: I suggest someone with authority, change managment personal at the Goodyear AZ branch.bank location.

California EDD card

I did not apply for benefits thru California Bank of America EDD .

Someone else did using my name and SSN, and they know my e mail address

Where did you send the EDD card to in first place ?

It was you who did this and you who closed my personal account also.

Even though I have done nothing.

Who ever you sent it to has taken $12, 000 so far.

I have e mail receipts to prove this.

I know the card is blocked now.

So whom ever cant take more.

I call this fraud...Plain and Simple

Desired outcome: I'm retired, and could use this EDD card for Senior benefits

international wire service transfer

I sent a international money wire transfer out of my savings account for $10, 000.00 and through my Bank which is Bank of America. My recipient can't get the money I transferred because it needs a couple things fixed on the transfer per his Bank. And Bank of America Service Centers never help me solve my problem. And everytime that I call Bank of Americas Customer Service they all give me different answers. I'm getting fed up and ready to close my Bank Accounts. I have been a loyal customer for nearly over 30 years. I feel like I want to take legal action against them. Thanks Ken Holliday

Desired outcome: Fix my transfer

Claim # [protected]

I received a letter from Bank of America Prepaid claims department on October 27th 2021. The letter stated " We've completed our review regarding your claim and have credited your account for $14, 056.94. It never posted! They put $ 900.00 into my account as a charge dispute but that was it.

I spoke with a supervisor several times and pointed out that my claim was for half that amount. It was looked into and I was told it was duplicated for some reason, but now it was corrected. So, 3 1/2 weeks later, still no word. I called last night and I was told that 90 days has passed so the claims department has run out of time. I guess there is a time limit that they go by.

So, that pretty much sums it up.

Thank you for your time

Sincerely Wendy Lodge

Desired outcome: I would like my account to be credited

Policy for contribution to non-profit organizations

Today, I learned from a report made by a Texas Congressman that in California, Bank of America is or has contributed to Non-Profit Organizations who are now engaged in Illegal distribution and transportation of Illegal Immigrants into the United States who have violated our immigration laws.

I am a Preferred Rewards Platinum Honors Member and I am greatly concerned that my financial institution may be involved in this sort of thing.

I would like to receive, as I'm sure many other banking clients would, an explanation from Bank of America's Senior Management concerning this matter.

Respectfully,

Charles Demack

Desired outcome: Clarification and Explanation

Bank account closure no notice at all no reason at all

On the weekend in November I suddenly got locked out of my boa account they closed me with no notice and or explanation It was an executive decision When I called reps were so rude all of them and they could not tell me why .I need someone to contact me from higher up to contact me asap this put me in a awful situation I am being treated like a criminal.I have always had trouble with my phone as well with it being bugged or something ver very strange would always act strange when I would call or in using the app What is going on I still have no answers . Extremely rude unprofessional and I just don't get it no warning no letter etc it has been almost 2 weeks

Overdraft fee on positive account

11/12/21 I was charged an overdraft fee on my account which was positive and this led to my account turning negative. They then charged an additional overdraft because it was negative, which again, was their fault in the first place. After a half hour of waiting for someone, I was able to speak to someone I could barely understand. Her lack of care was apparent from the start when the first thing she did was put me back on hold. They then told me since those charges were pending, and wouldn't be able to help and that I should try again tomorrow. How is this even legal?

Desired outcome: I just want the overdraft fees removed.

Withdrawal of funds from deceased parent

My fathered passed I'm benifciary on BofA acct and Merril Lynch acct.

I'm the only son made appointments for BofA and Merrill Lynch. Brought Will and Death Certificates, filled out all paperwork, signed multiple documents, notarized and faxed/emailed paperwork with banks officers.

Two weeks later on Veterans day 11/11/2021 I get an UPS package asking for all the paperwork I already completed to be completed again from Merrill and not a peep from the BofA side.

Desired outcome: Cashier's check for funds

Credit Card (Amtrak)

I opened a credit card while booking a trip on Amtrak in 8/19/2021. I received the credit card with a $9, 000 credit limit and used it once to book the trip. I waited for my statement in the mail so that i could set up ACH payment through my checking account. I did receive other mail once with checks to use to pay bills or transfer balances which i did not use.

on November 9 after still not receiving a statement by US Mail i tried going onto their site to create an account so that i could retreive statements this way.

i called and informed Customer Service that i have not received a statement and tried creating an account on line and was told my account was locked. The customer service was more than happy to take my payment over the phone but would not waive the late fee of $29.00. i asked to speak with a manager / supervisor and was told they could not waive it either.

I paid my credit card off of $394.50 which included a yearly membership fee and closed my account.

i then spoke to a supervisor who told me that he could not waive the late fee either it is company policy.

what a sham this is.

Sharon Taggart,

Bill Pay and ACH Department

Bank of America is holding my money for over 2 weeks without proper notice or merit.

Unfortunately, we paid the wrong credit card balance off by sending a rather large Bill Pay from our Bank of America checking account to our Fidelity credit card account during the first half of October. Once we caught the error, we partnered with Fidelity and Bank of America to reverse the payment. Additionally, Fidelity both confirmed the transaction was completed on October 27th at 7am, which Bank of America also confirmed receiving.

Since that time, Bank of America has held the funds and each time we've called for support - Bank of America has given us a variation of stories as to why the funds are not back in our account.

Here is what we know: Bill Pay is performed by ACH which, according to Automated Clearing House (ACH) Payments Processing (bofa.com), transactions clear next day. We've found this to be true for every ACH through Bank of America transaction (incoming or outgoing) UNTIL THIS ONE. Our paychecks, bills, transfers all happen quickly. However, Bank of America has held these funds for more than 2 weeks thus far. Also, within the link to ACH information, Bank of America touts a "Robust audit and management reports provide you with summary and detailed information, including:

• Daily summary reporting of all transaction and authorization activity

• Reporting of all authorizations and maintenance activity

WHERE IS MY $19K - WHY IS THE BANK HOLDING MY MONEY?

On October 28th, I called Bank of America's Bill Pay Department who again confirmed the payment of $18, 914.20, was received on the 27th of October at 7am. I asked for a confirmation number - they said there wasn't one. I asked where I would go to look at the pending transaction - they said there wasn't one. They did say the funds would be back in our checking account no later than end of business day, October 29th.

On Saturday, October 30th, the funds were still not in our account.

On Monday, November 1st, the funds were still not in our account nor were any pending transactions showing on our account. I called Bank of America Bill Pay Customer Service who notified me the funds should be in the account by end of day tomorrow, November 2nd. I asked for a confirmation number or a way to view the transaction - they said this type of transactions don't fall into pending transaction and so, there isn't any record for me to view.

On Wednesday, November 3rd, the funds were still not in our account nor were any pending transactions showing on our account. I again called Bank of America Bill Pay Customer Service, who said they would escalate the issue and gave me a case number with the last four digits of 2437. They said we should have an answer back within 2 days.

On Friday, November 5th, the funds were still not in our account nor were any pending transactions showing on our account. Again, I called Bank of America Bill Pay Customer Service, who said the case was closed and we should have funds in our account by the end of the day.

On Saturday, November 6th, the funds were still not in our account nor were any pending transactions showing on our account. Again, I called Bank of America Bill Pay Customer Service, who said the funds are being held for 7 days to confirm they are received - to protect us from having any issues…WHAT? Again, we escalated and the person we were transferred to. This person stated the investigator works in another country and will need to review the case, which will take two business days. We were instructed to wait and call back on Tuesday, November 9th if the funds were not in our account.

On Tuesday, November 9th, the funds were still not in our account. I got on the phone again with Bank of America customer service, was transferred to Jackie in the Bill Pay department, who told me to call a different Bill Pay Department at [protected]. After being on hold for a long time, I called the regular customer service and started over. I spoke with Kia, who confirmed the funds were transferred via ACH and asked for the following

• Where to see the funds and status - we have nothing showing on Bank of America

• A reference number or confirmation number about the funds

• An escalation number/ticket

I was put on hold while she spoke to a supervisor, who then joined the call who I believe was named Das, who let me know that although Bank of America received the funds on the 27th of October, they

• Decided to put a hold on the amount on Nov 3rd - over a week later. Basically, one week after the funds cleared, BofA flagged the payment as a risk and going through a credit trace on Nov 3rd, which is a violation of NACHA and FDIC rules for ACH Funds. Additionally, the funds are coming from another FDIC BANK.

• This supervisor did ask for funds provision of credits for hardship on my behalf. However, since I have funds in my account and am not bouncing checks, I am not provided this service.

After nearly 3 hours on the phone - I have zero progress with Bank of America. The supervisor said the case is re-opened and will take 1-2 business days to resolve. Yeah right, I've heard that before.

THIS SEEMS HIGHLY ILLEGAL AND DECIEVING

From researching the NACHA laws and lawsuits filed against Bank of America such as ACH Transfer Fee Class Action Lawsuit | NAFCU I quote "…for any given payment or transfer, the NACHA system allows the payee to affirmatively send it or the payor to simply take funds from an account. An accountholder wishing to make a transfer from their BofA account can easily accomplish this by either "pushing" the funds from BofA via BofA's online banking portal or "pulling" the funds from BofA via a portal operated by the receiving financial institution. The end result is the same: money transferred seamlessly, electronically, and quickly between accounts. BofA is engaged in a multi-prong effort to deceive its accountholders about the workings of the NACHA system…"

According to FDIC, Electronic payments received by your institution for deposit in an account--An electronic payment (a wire transfer or an ACH credit) is considered received (deposited) when your institution has received both payment in collected funds and information on the account and the amount to be credited. (Under other rules, funds for most electronic deposits are made available on the day of deposit.)

It goes further to say that large deposits (greater than $5, 000) --Any amount exceeding $5, 000 may be held. Your institution must make the first $5, 000 of the deposit available for withdrawal according to your availability policy and the remainder within the "reasonable" time frames discussed in the paragraph above.

Truly, this is a devious act of the bank.

Desired outcome: Bank of America should 1-provide a formal apology 2- provide me the full history of this transaction and all the communications Bank of America should 3-give my funds to me along with any income earned from holding the funds.

Unethical behavior, customer service and lack of knowledge

Bank of America-Country Club Plaza Branch

MO8-512-01-01, 451 West 47th Street

Kansas City, MO 64112

My father was 87 years old when he passed away in May 2021. Our mother is an 81-year-old grieving widow who has functional impairments.

After my father's death, our mother, Helen, made several attempts over three to four weeks to withdraw the remaining funds from their checking account. With each visit to the Bank of America, she was denied by the bank teller Susan B. and Shala A. branch manager. Again she was asked to provide additional information. Upon each visit she brought the requested documentation that included Ester Sledge's bank account number, monthly bank statements with both his and her name, his death certificate, and his Social Security number only to find out again she was not able to withdraw funds. Each visit increased her anxiety, stressed her, and felt distraught.

My mother spoke with a banker named Susan Brandt, Relationship Banker who told my mother she needed more additional information including (1) Formal Probate and (2) Missouri Estate Affidavit and (3) Beneficiary Letter of Instruction in order to withdraw the balance of funds from her deceased husband's account.

So, my grieving mother went back home more stressed out, extremely upset, crying, confused, and more distraught as to why she could not withdraw the money and why she needed more documentation and was not told up front what was needed.

In our opinion, Bank of America's Shahla, Vice President, Financial Center Manager, and Susan, Relationship Banker showed gross negligence and incompetence due to the lack of knowledge of how to properly assess this situation, gather the correct information to provide instructions to a grieving widow/customer in order to withdraw the remaining balance in her deceased husband's account to pay mounting bills, buy food and continue to purchase her prescription medications, and showed no sympathy with this matter.

Upon visiting with my mother, she shared this information with me (her daughter). My mother and I went back to the Country Club Plaza-Bank of America branch to speak with manager Shahla Adams in hopes that more information would be provided and clarification about what and how much more documentation was needed to withdraw the remaining balance.

When my mother and I arrived at the Country Club Plaza-Bank of America branch on October 8th, 2021, we spoke with Shahla VP, Financial Center Manager. She basically knew nothing and kept repeating "I think Susan did a great job explaining" and she did not offer resolution or provide any information about the account at all. Period. And furthermore, she did not know what a Formal Probate or a Missouri Estate Affidavit was or why Susan said we needed it to provide these documents to withdraw the remaining balance. Her response was "I am not a lawyer and can't help you" in a disrespectful raised tone of voice.

I don't understand why she spoke to us in a raised tone of voice, was argumentative, and interrupted our questions with a dismissive attitude which was very rude, insensitive, and extremely unprofessional.

In our opinion, Shahla has a very serious and concerning lack of knowledge for her title and awful customer service skills. There is a concern for her lack of professionalism and knowledge, and responsibilities to customers pertaining to what documentation was needed and any other necessary information with job title who represents the Bank of America (at that branch)

Lastly, when our family was visiting out of state, we went with mother to another one of the Bank of America branches in Kansas City, Missouri on 31st and Main around October 13th, where a staff banker stated they have to wait an additional 14 days to withdraw the remaining balance in Ester Sledge's account without properly assessing the situation and without requesting the documentation the Country Club Plaza location said we needed.

That day we had a notarized signed document by a lawyer to release the funds from Bank of America. And by the way, that notarized document was not the same the bank representative Susan told my mother she needed.

Again, lack of knowledge and incompetence of banking staff on how to assess the situation, provide correct information and request/required documentation, follow-through, and professionalism with banking customers.

This was an awful experience. And it is with hope no one will ever have to go through what our mother and our family went through during the time of losing a loved one and grieving causing more mental distress, emotionally distraught, and physical fatigue.

The way our mother was treated during a very difficult time in her life was rude, unsympathetic, cruel and insensitive and uncalled for. And, she would not want anyone else to go through what she went through at any of the Bank of America branches mentioned.

International Transfer

Greetings,

On August 16, 2021 I wrote a letter to Bank of America regarding a discrepancy from a bank in the Netherlands to my checking account with BAC ending in 3636. Thus far I have not received any kind of response to my writing.

Please contact me at your earliest convenience to have this issue finally resolved.

[protected]@mchsi.com

Account Nr. [protected]

Closed my account

Bank of America Closed my account with a amount of $830 without me knowing and I walk into the bank of America to take out some money and that's when the teller told me your account being closed and send the money to your house, I ask the teller what she told I don't know call the customer service number and I did and they told me go inside the the bank and speak them, I did both and both told me they will send me a check home and I haven't received nothing

Desired outcome: My money back a s.a.p

Fees

They will charge you as many fees as possible so you know business is bad for them. Bank with Chase instead of B of A.

Desired outcome: Fee reversals

Bank of America Reviews 0

If you represent Bank of America, take charge of your business profile by claiming it and stay informed about any new reviews or complaints submitted.

About Bank of America

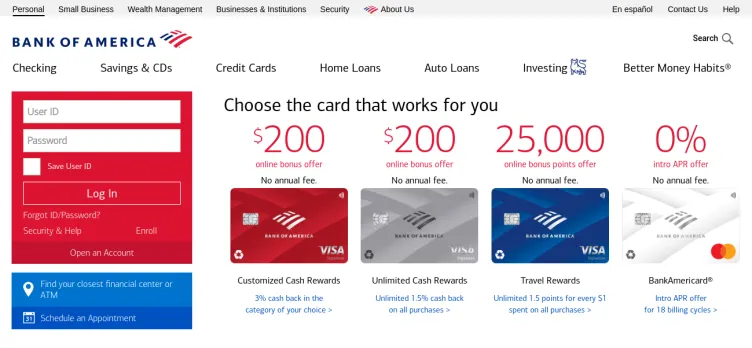

One of the key strengths of Bank of America is its commitment to innovation and technology. The bank has invested heavily in digital platforms and mobile banking, making it easier than ever for customers to manage their finances on the go. With features like mobile check deposit, online bill pay, and real-time account alerts, Bank of America is at the forefront of the digital banking revolution.

In addition to its digital offerings, Bank of America also has a strong network of physical branches and ATMs. With thousands of locations across the country, customers can easily access their accounts and get help from knowledgeable staff members whenever they need it.

Another key advantage of Bank of America is its wide range of financial products and services. From checking and savings accounts to credit cards, loans, and investment products, the bank offers something for everyone. Whether you're looking to save for the future, buy a home, or invest in the stock market, Bank of America has the tools and resources you need to achieve your financial goals.

Overall, Bank of America is a trusted and reliable financial institution that has been serving customers for over a century. With its commitment to innovation, technology, and customer service, the bank is well-positioned to continue to meet the evolving needs of its customers for many years to come.

1. Log in or create an account: Ensure you are logged in to your ComplaintsBoard.com account to proceed. If you do not have an account, please register by providing the necessary information and verifying your email address.

2. Navigating to the complaint form: Once logged in, locate the 'File a Complaint' button situated at the top right corner of the website and click on it to access the complaint form.

3. Writing the title: In the 'Complaint Title' field, concisely summarize the main issue you have encountered with Bank of America. Make it specific and clear, such as "Unauthorized Overdraft Fees" or "Difficulty with Mortgage Loan Modification".

4. Detailing the experience: In the complaint description, provide a detailed account of your experience. Include key areas such as customer service interactions, problems with account management, loan servicing, fees or charges that were unexpected, issues with online banking, or any other specific incidents related to Bank of America. Clearly describe the nature of the issue, including dates, locations, and any relevant transaction details. If you attempted to resolve the issue, outline the steps you took and the responses received from Bank of America. Explain how this issue has personally affected you, such as financial loss or stress.

5. Attaching supporting documents: Attach any relevant documents that support your complaint, such as correspondence, statements, or receipts. Be cautious not to include sensitive personal information like your social security number or full account numbers.

6. Filling optional fields: Use the 'Claimed Loss' field to quantify any financial losses you have incurred due to the issue. In the 'Desired Outcome' field, describe what resolution you are seeking from Bank of America, whether it be a refund, apology, or corrective action.

7. Review before submission: Carefully review your complaint for clarity, accuracy, and completeness. Ensure that all the information provided is true to your knowledge and that your desired outcome is reasonable and clearly stated.

8. Submission process: After reviewing your complaint, click on the 'Submit' button to officially file your complaint on ComplaintsBoard.com.

9. Post-Submission Actions: Keep an eye on your ComplaintsBoard.com account for any responses or updates regarding your complaint. Be prepared to engage in further communication if necessary to resolve your issue with Bank of America.

Overview of Bank of America complaint handling

-

Bank of America Contacts

-

Bank of America phone numbers+1 (800) 432-1000+1 (800) 432-1000Click up if you have successfully reached Bank of America by calling +1 (800) 432-1000 phone number 8 8 users reported that they have successfully reached Bank of America by calling +1 (800) 432-1000 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number 3 3 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 432-1000 phone number45%Confidence scoreEnglish+1 (800) 688-6086+1 (800) 688-6086Click up if you have successfully reached Bank of America by calling +1 (800) 688-6086 phone number 16 16 users reported that they have successfully reached Bank of America by calling +1 (800) 688-6086 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number 2 2 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 688-6086 phone number78%Confidence scoreSpanish+1 (315) 724-4022+1 (315) 724-4022Click up if you have successfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (315) 724-4022 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (315) 724-4022 phone numberInternational+1 (757) 677-4701+1 (757) 677-4701Click up if you have successfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (757) 677-4701 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (757) 677-4701 phone numberCredit Card Issues+1 (800) 214-6084+1 (800) 214-6084Click up if you have successfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (800) 214-6084 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (800) 214-6084 phone numberVice President Bank+1 (312) 992-6618+1 (312) 992-6618Click up if you have successfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have successfully reached Bank of America by calling +1 (312) 992-6618 phone number Click down if you have unsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number 0 0 users reported that they have UNsuccessfully reached Bank of America by calling +1 (312) 992-6618 phone number

-

Bank of America emailssupport@bankofamerica.com100%Confidence score: 100%Support

-

Bank of America address100 N Tryon St., Charlotte, New York, 28255, United States

-

Bank of America social media

-

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreFeb 20, 2025

Checked and verified by Janet This contact information is personally checked and verified by the ComplaintsBoard representative. Learn moreFeb 20, 2025 - View all Bank of America contacts

Most discussed complaints

ATM security firm illegal in nycRecent comments about Bank of America company

ATM security firm illegal in nycOur Commitment

We make sure all complaints and reviews are from real people sharing genuine experiences.

We offer easy tools for businesses and reviewers to solve issues together. Learn how it works.

We support and promote the right for reviewers to express their opinions and ideas freely without censorship or restrictions, as long as it's respectful and within our Terms and Conditions, of course ;)

Our rating system is open and honest, ensuring unbiased evaluations for all businesses on the platform. Learn more.

Personal details of reviewers are strictly confidential and hidden from everyone.

Our website is designed to be user-friendly, accessible, and absolutely free for everyone to use.